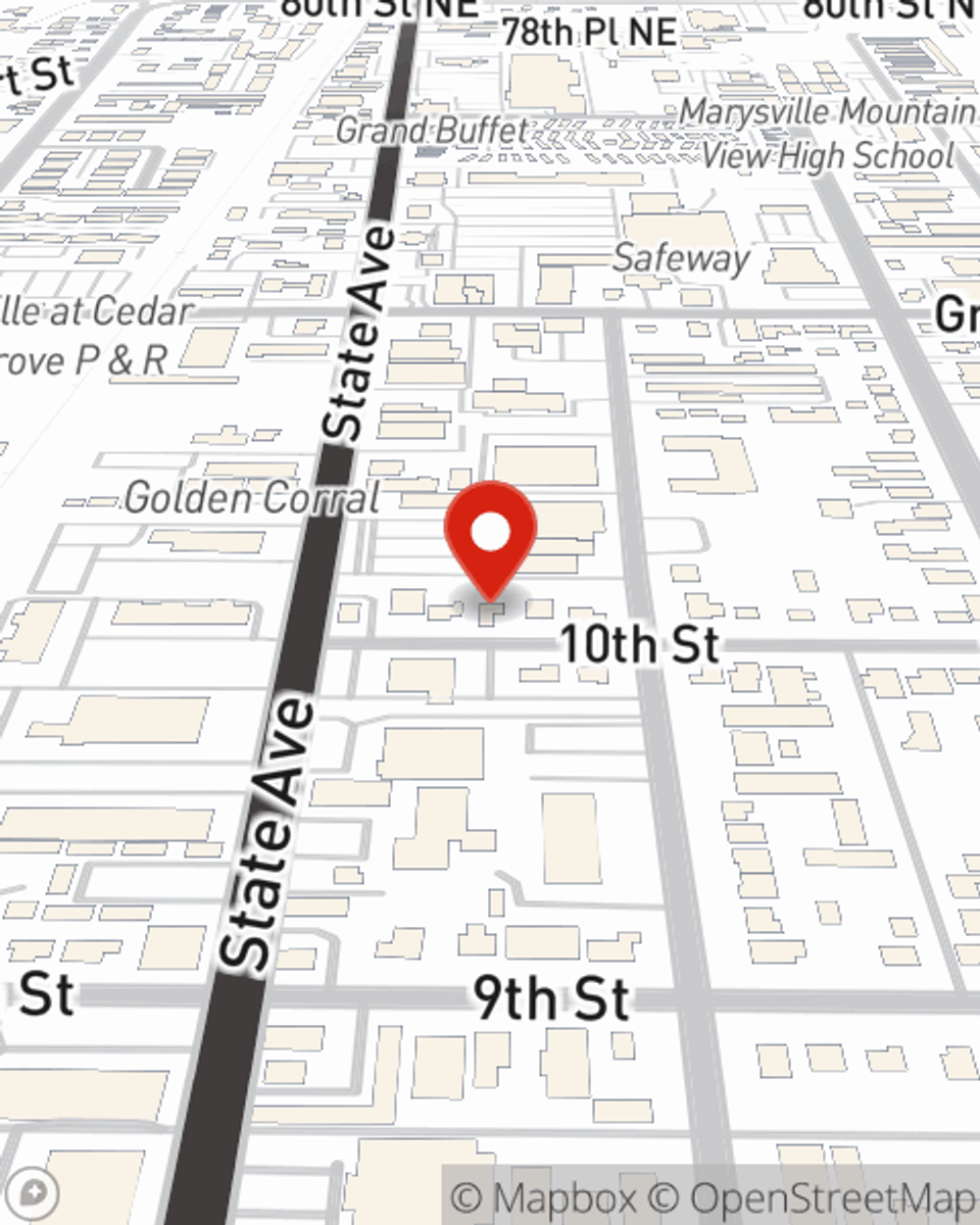

Condo Insurance in and around Marysville

Looking for outstanding condo unitowners insurance in Marysville?

Cover your home, wisely

- Snohomish County

- Washington

- King County

- Skagit County

- Marysville

- Everett

- Lake Stevens

- Seattle

- Bellevue

- Mill Creek

- Bothell

- Snohomish

- Idaho

- Oregon

- Stanwood

- Mount Vernon

- Lynnwood

- Mukilteo

- Bellingham

- Edmonds

- Arlington

- Camano Island

- Kirkland

- Redmond

There’s No Place Like Home

When it's time to chill out, the safe place that comes to mind for you and your favorite peopleis your condo.

Looking for outstanding condo unitowners insurance in Marysville?

Cover your home, wisely

Why Condo Owners In Marysville Choose State Farm

You want to protect that unique place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as lightning, fire or freezing of a plumbing system. Agent Brian Pepelnjak can help you figure out how much of this wonderful coverage you need and create a policy that works for you.

Ready to learn more? Agent Brian Pepelnjak is also ready to help you explore what customizable condo insurance options work well for you. Get in touch today!

Have More Questions About Condo Unitowners Insurance?

Call Brian at (360) 653-2582 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Brian Pepelnjak

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.